Will Smart Beta Return?

The Magnificent 7 had smart beta down for the count in 2023. Will it return in 2024?

I’m mostly focused on the US market these days, but as I’ve spent a large chunk of my career focusing on the UK market (in fact, I believe my UK investing record may top my US one), I still follow things UK and like many folks, find myself asking what it will take to pull the market of the world’s once-mightiest empire up from the perpetual doldrums. Axios asks why the recession-prone UK economy has so lagged the also-recession-prone Japanese economy (and finds fault with the LSE’s IPO standards), and the FT Lex column suggests getting research into the hands of laymen & laywomen will help.

Call me judgmental or call me master of the obvious, but the UK needs a shot of dynamism. Send an work email at 5:01pm in London and you’ll get an answer the next day. In the States, people might be reply until 8pm or 9pm. In Shenzhen, you get replies at 11:30. I’m not endorsing workaholism and not saying that later is good. But I am saying that when opportunity is there, people make things happen. When it’s not, they don’t.

Source: Axios

Anyway, I’ve gotten a few requests for outdoor adventure photos, so a few ice climbing pics follow the below excerpt of a post from the BBAE blog.

This Investment Underdog Had an Awesome 2023

Americans love stories of underdogs. Stories of unexpected triumph. Stories that evoke the US’ own underdog-beats-the-powers-that-be origins.

I have one for you today.

Let me set the stage first.

If you read my prior article about the genesis of capitalization-weighted indexes, you remember that a pie chart of the S&P 500 looks like this:

Although the S&P 500 is the de facto large-cap benchmark, most stocks in it are small caps – and most have tiny weights, as you can see by the psychedelic-looking left side.

Weighting indexes by market cap was a step forward from Charles Dow and Edward Jones’ stock price weighting, but it led people to wonder: do index-following investors always get the best performance when the biggest companies have more weight?

No.

In fact, it’s usually the opposite.

An equally weighted S&P 500 index debuted about 20 years ago. Not coincidentally, the INVESCO S&P 500 Equal-Weight ETF (NYSE: RSP) debuted at roughly the same time.

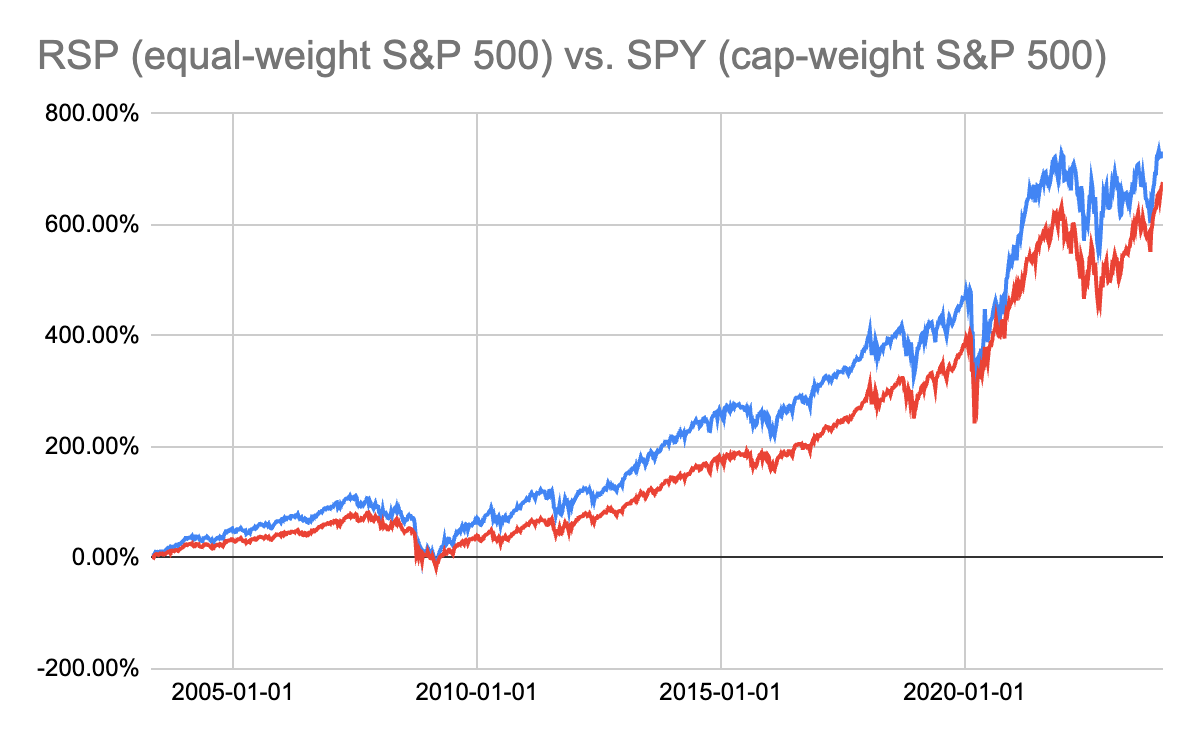

Despite having more than double the annual management fee (0.20% vs. 0.09% for the SPDR S&P ETF (NYSE: SPY)), and despite being a boring index fund, RSP has noticeably outperformed its cap-weighted brother since inception:

It’s not a fluke: academic evidence has shown small caps to do well, and the equal-weight index gives them more voting power.

Equal-weight S&P 500 beat nearly 100% of US fund managers

Embarrassingly, if the equal-weight S&P 500 were an active manager, he or she would have earned massive bragging rights by outperforming very close to 100% of mutual funds over the past 20 years.

It would almost seem that you needed only to buy an S&P 500 equal-weight index and your investing life would be complete.

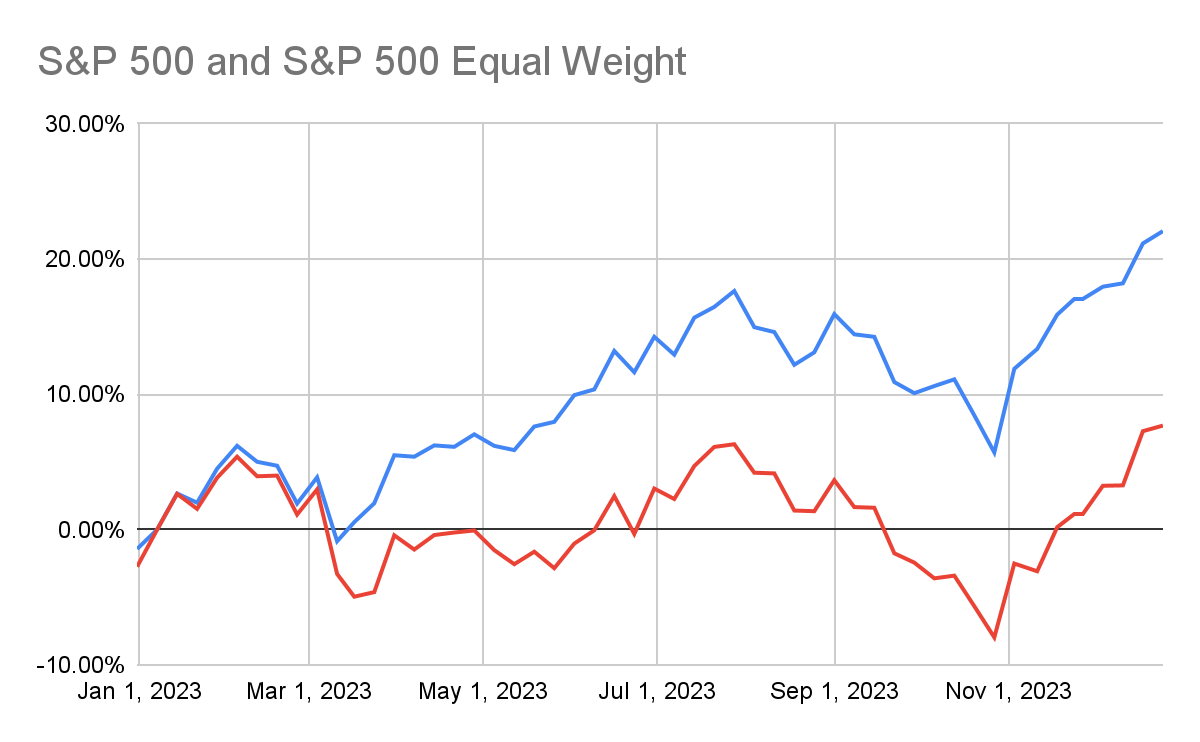

Then 2023 happened:

Different “factors” (reasons stocks move) dominate at various times – size, dividends, growth, etc. – and 2023 was the year of large caps dominating with a vengeance. In fact, only 24% of S&P 500 constituents beat the index in 2023, which is one of the lowest proportions ever.

The Magnificent Seven’s triumph was not a bad thing: these stocks were widely held by investors. It was, though, a low point in the equal-weight’s otherwise-stellar storyline.

Why did large caps trounce smaller stocks in 2023?

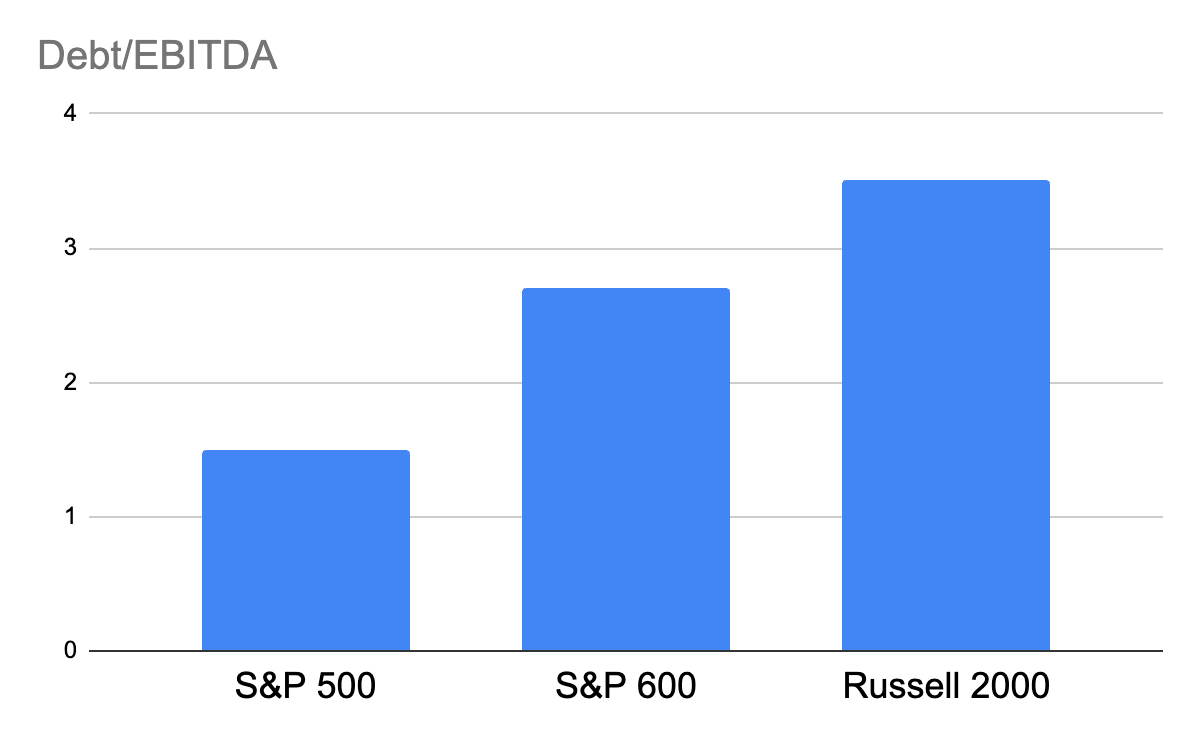

Partly, investors were just fired up about large tech stocks and kept buying them despite rising interest rates. Partly, rising rates slammed smaller companies (which have both more debt and a greater percentage of floating-rate debt than large companies) disproportionately.

Enter: Smart Beta

The term “smart beta” was coined by a consultant at Willis Towers Watson in 2006.

It’s largely a marketing term, which irks some practitioners because it’s used so broadly. (It really irks Bill Sharpe, coiner of “beta,” presumably because of the implication that his beta may be the “dumb” beta.)

Let’s sidestep the nomenclature debate and simply define smart beta indexing as any act of creating a market-ish index using factors aside from market cap or price.

Equally weighting the S&P 500 could be, therefore, a primitive version of smart beta. Again, the main point is to a) make an index to follow – the “beta” part – that b) channels factors other than market cap – the “smart” part, at least hopefully so.

Smart beta has been hot with investors, drawing in half of ETF inflows in some recent years. But not in 2023: actively managed ETFs drew more inflows.

Given smart beta’s track record, though, it’s not surprising that smart beta still has believers and some are asking if this current relative soft spot marks a great time to buy into smart beta funds.

And quite separately a few climbing pics:

Not gunning for fashion awards. And no, I haven’t put on weight; I’ve got mittens stuffed into my jacket pockets.

The slog up to the base of the climb was the most tiring part.

Ice screws protect you if you fall.

For the plant nerds: A dwarf form of Picea rubens (Red spruce) arising from a spontaneous mutation. Remaining understory primarily Abies balsamea.